Viewing Transaction Currency Rates in X3

Viewing Transaction Currency Rates in X3

Sage X3 multi-currency translates transactions entered in foreign currency into your native accounting or ‘ledger’ currency and automatically provides any exchange variance (gain/loss) due to currency fluctuations for these transactions.

In this blog post, we will look at an example that shows how Sage X3 handles invoices and payments in a foreign currency (EUR) with an unrealized currency gain.

AP is a multi-currency ledger, meaning that AP Vendors that transact in EUR will have their balance aged in that currency, and users are able to cancel the invoices in that currency using a EUR account.

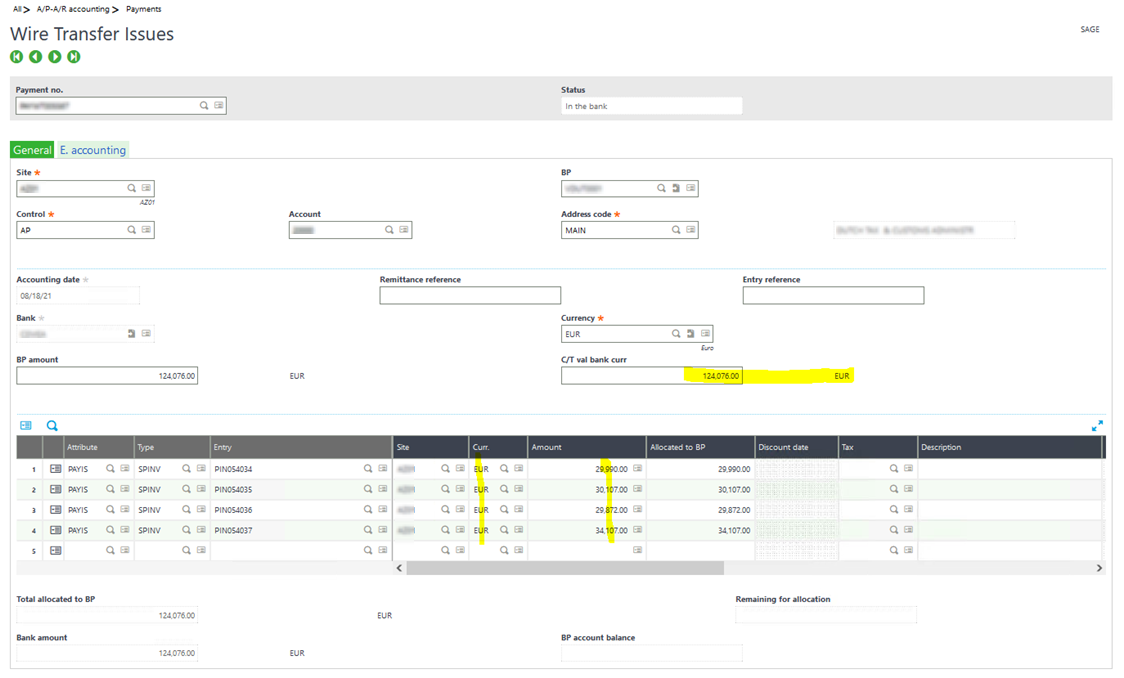

Here’s an example of a payment:

As we can see, the payment was in Euros, the invoices were shown and paid in that currency using the EUR bank account. No conversion takes place in the AP sub ledger.

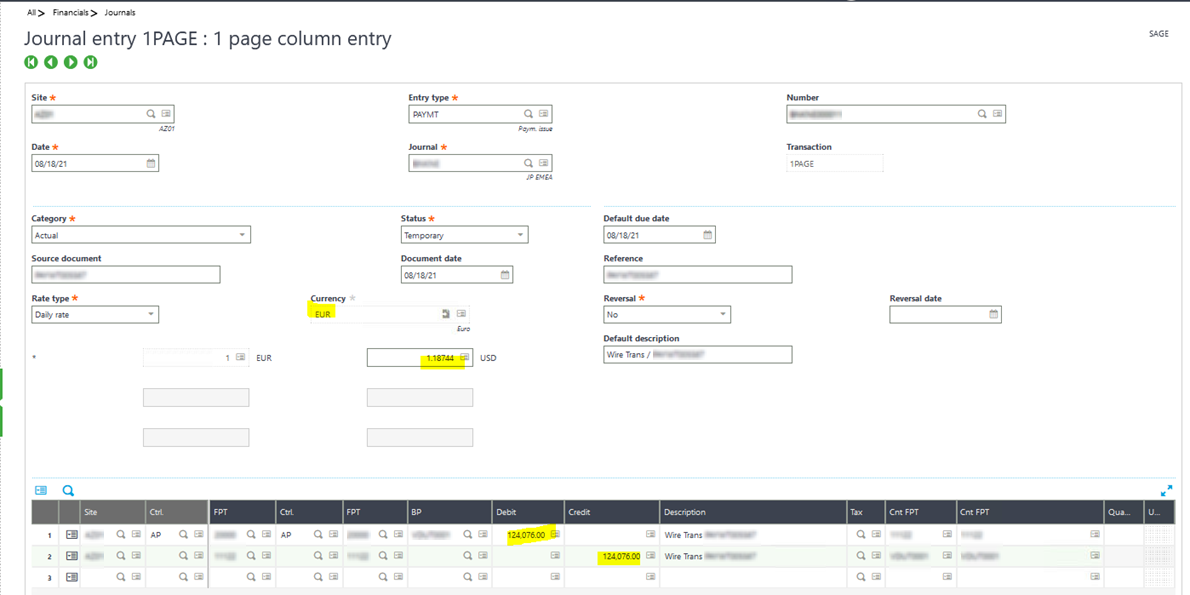

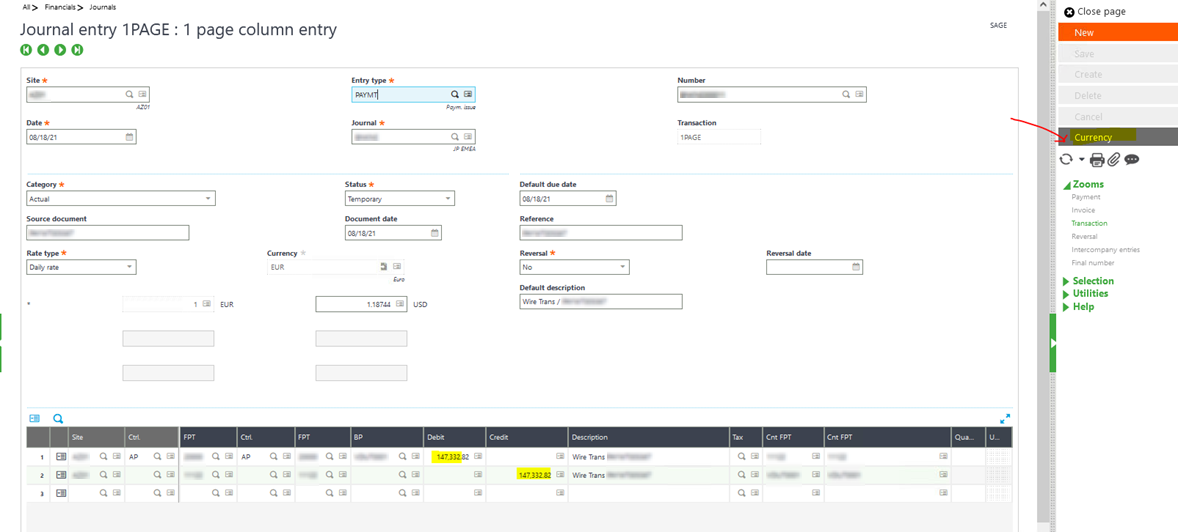

Now, in the GL we see the entry made in EUR:

But also, by hitting the ‘Currency’ button, we can see the conversion done by Sage X3. The rate used (1.18744 USD) corresponds to the posting date.

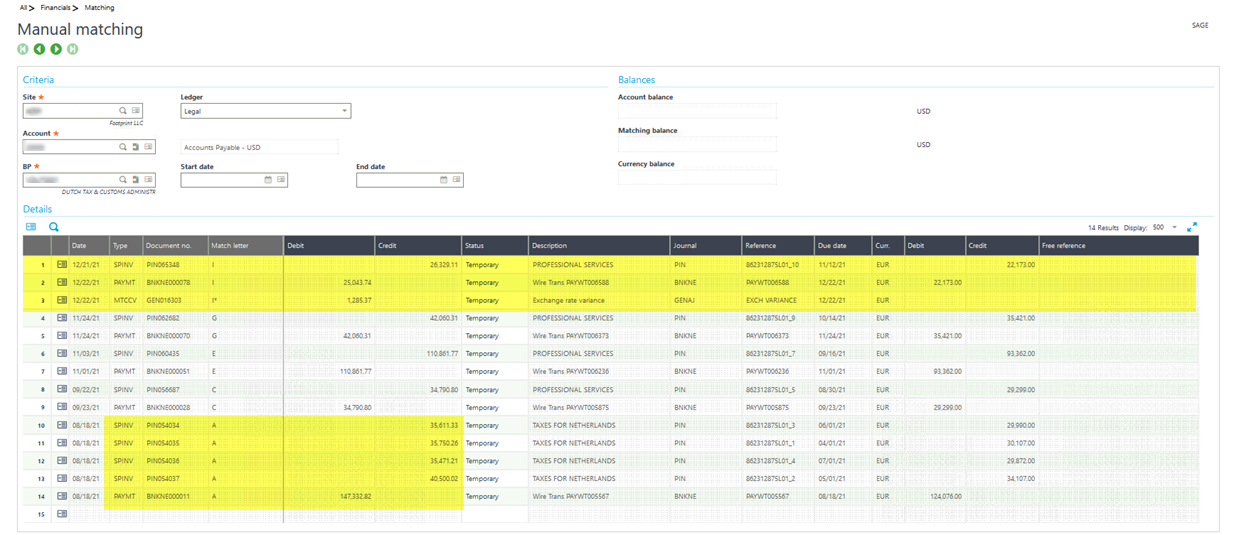

Now, let’s look at the Manual Matching screen. Here you can see what Sage X3 did with these amounts and the side by side translation from the transaction currency (EUR) to the ledger currency (USD):

This payment for 147,332.82 EUR is perfectly matched against the four invoices that it is paying (Match Letter A). However, if you look at PIN065348, the Invoice was for 22,173.00 EUR, against the payment of 22,173.00 EUR, but the invoice was created at a given rate that translated the EUR to $26,329.11 USD, and the payment was made for $25,043.74 USD. The difference, or exchange rate variance, of $1,285.37 means that the USD appreciated against the EUR in that period—resulting in an unrealized currency gain.

Hopefully walking through this example helps explain how Sage X3 treats invoices and payments in a foreign currency (EUR) with an unrealized currency gain. If you have any questions about multi-currency support, or any other questions about Sage X3, please contact us.