Sage 300 Newsletter – April 2018

Keeping You Up-To-Date With Information About Sage 300

Revaluation of Multicurrency Transactions in Sage 300

By: Bella May, Sage 300 Business Consultant

If you use multi-currency accounting you need to periodically revalue transactions.

If you use multi-currency accounting you need to periodically revalue transactions.

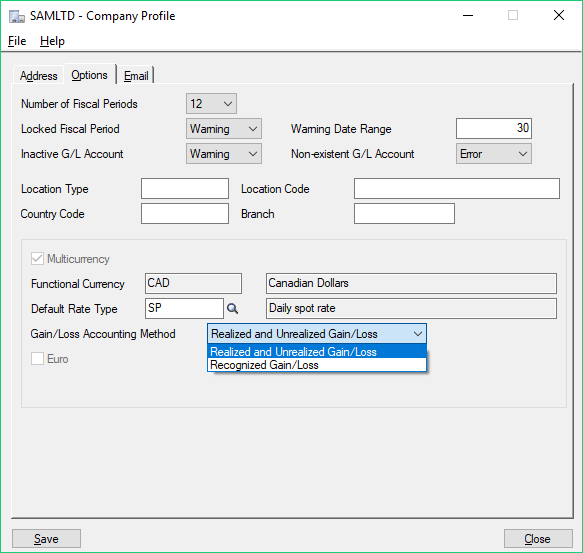

A Realized and Unrealized Gain/Loss accounting method revaluation is considered temporary. Exchange gains and losses are posted to unrealized exchange gain/loss accounts during revaluation and reversed in the next period.

A Recognized Gain/Loss accounting method revaluation considered permanent. Exchange gains and losses are posted to exchange gain/loss accounts during revaluation and not reversed in the next period.

Revaluation process requires following setup steps:

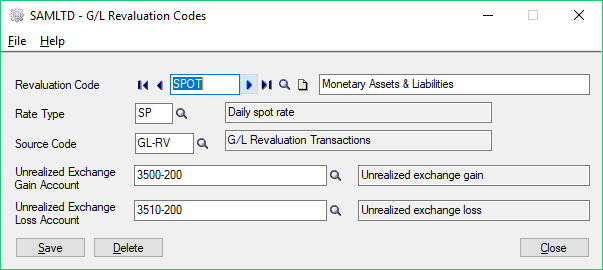

GL Setup -> Revaluation Codes

- Add Revaluation code

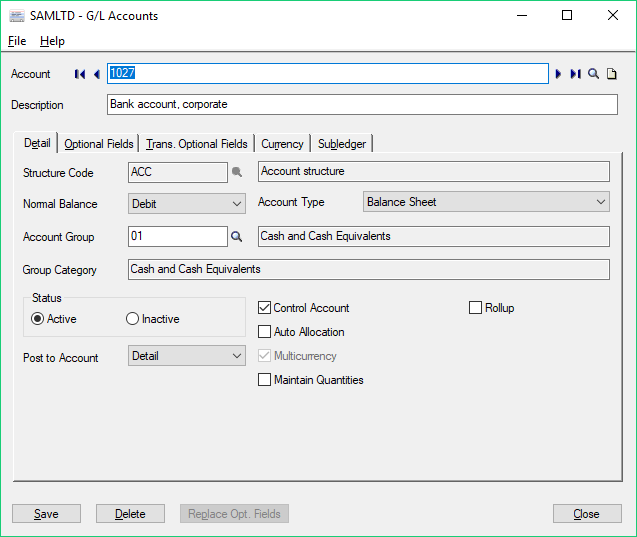

GL Accounts

- Flag GL account as multicurrency

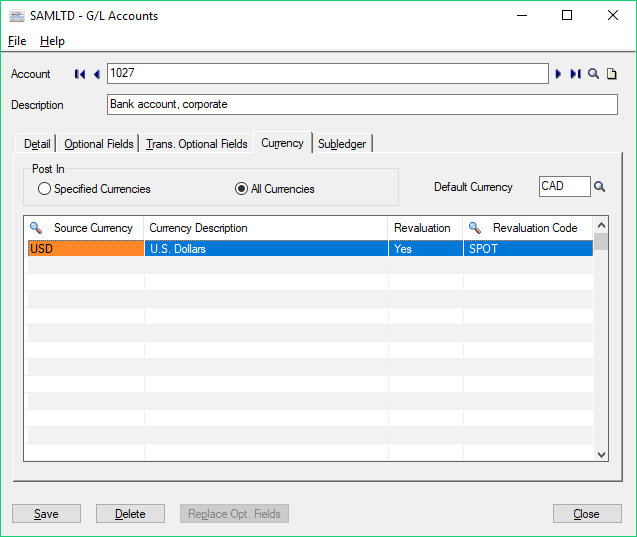

GL Accounts – Currency Tab

- Select default currency

- Specify source currency

- Set Revaluation option to Yes

- Select Revaluation Code

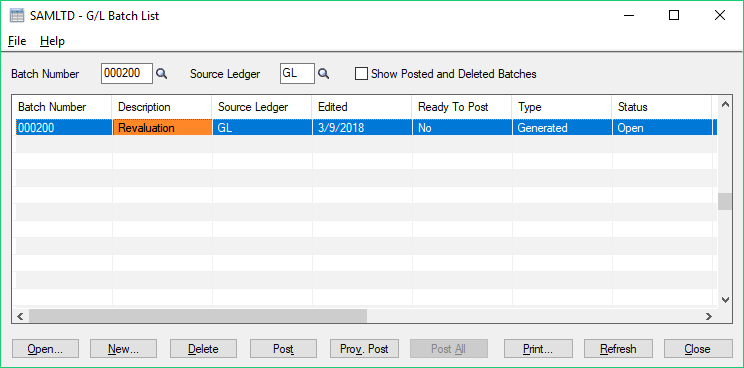

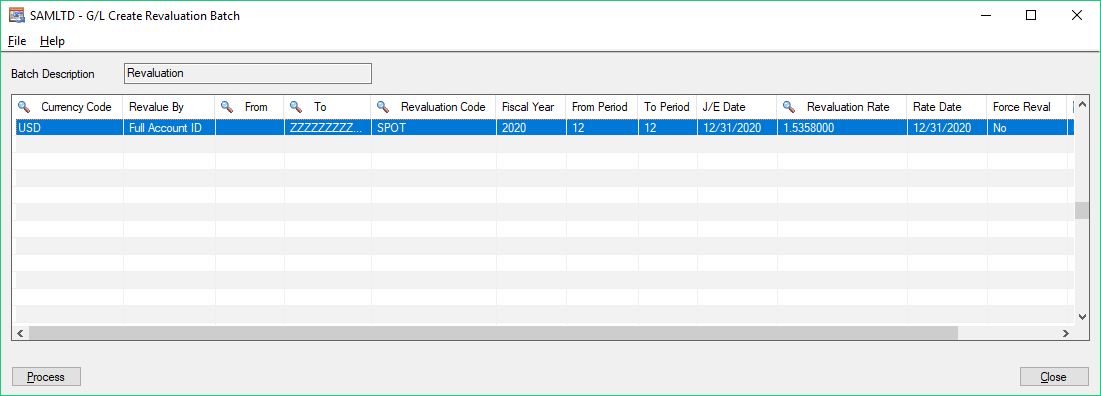

GL Periodic Processing -> Create Revaluation Batch

- Specify source currency

- Select range of Accounts From/To

- Select Revaluation Code

- Specify Fiscal Year and Period

- Specify journal entry date

- Specify Revaluation Rate/Rate Date

- Force Revaluation set to “No” – all accounts will be processed with Revaluation set to “Yes” for this currency on the GL accounts – Currency Tab screen

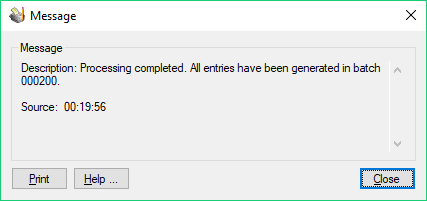

Process to create Revaluation Batch