The challenges in 2020 were unlike any we’ve seen in our lifetime. Much of your business processes were thrown into a whirl of changes. Fixed Asset Management became a topic for all coming to grips with remote users, new server hardware and tracking equipment on the move.

Fixed Assets Unleashed – Q1 2021

Keeping You Up-To-Date With Information About Fixed Assets

The Year End Checklist – 8 Steps for Depreciation

By: Suzanne Pedone, Fixed Asset Subject Matter Expert

I am sure Year end is in full swing for Accounting teams everywhere. Net at Work Fixed Asset clients range from Non-Profit Organizations, US corporations and even Canadian Companies. Every year company tasks vary depending on the tax rules, or IRS requirements.

Sage 300 ERP & Fixed Assets Depreciation Options

By: Net at Work Team

When you have Sage 300 ERP as your Accounting solution, there are two products that will work nicely for your Depreciation tasks. There are a lot of things to consider also with services related to implementing either product. Net at Work has seasoned Consultants on staff for either product.

Cloud Hosting for Sage Fixed Assets

By: Net at Work Team

Sage Depreciation does not have a web-based solution, however in an effort to meet our clients concerns such as, increasing onsite hardware costs, internal I.T. staffing time and efforts, and the rising Ransomware issues we have providing hosting plans via our Cloud at Work sister company.

Recent Tax Updates 2020 & 2021: What You Need to Know?

By: Net at Work Team

What’s New for Fixed Assets in 2021? Every year Depreciation tax has new rules and some extension of old ones. Is your software up to date? Remember the forms will print for the previous tax year. Release 2021 will generate 2020 Tax forms.

Tax Extender Updates

By: Net at Work Team

The Further Consolidated Appropriations Act, 2020 extended many tax provisions that were about to or had previously expired.

Client Success Corner: Greater New Haven Transit Authority

By: Net at Work Team

So often organizations have requirements to inventory assets once a year. The process is often manual starting with printing a depreciation listing report for someone to ‘check’ off, only to have to go back into the software to update those assets with a Found Status. Sage Asset Tracking provides the tool for clients to move from a manual inventory process to a digital and more effective process.

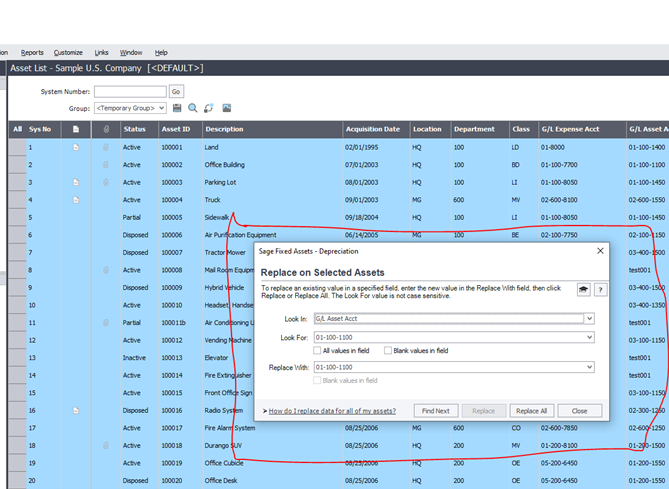

Sage Depreciation Software Tip

We often get asked “Is there an easier way in Sage Depreciation to edit all our GL account numbers that are getting changed?”

Yes! Here are the steps.

- Use Group View to OPEN the Complete Assets Group go to the EDIT Menu / Select ALL

- Once they are all ‘blue’ and selected Re Open EDIT Menu / REPLACE

- Populate the Look in with the OLD GL Account and Populate Replace with the new GL Account