Employer Solutions / HRMS Newsletter – September 2016

Keeping You Up-To-Date With Information About Employer Solutions / HRMS

Mandatory Sick Leave – 4 Steps to Consider & How Sage HRMS Can Help

Employers throughout the US are dealing with the rise of mandatory sick leave.

Employers throughout the US are dealing with the rise of mandatory sick leave.

As of August, 2016, twenty-six municipalities, one county, five states, the District of Columbia and, under certain conditions, the Federal government have passed laws requiring paid sick leave for employees. That number is likely to grow. On the one hand, as millennials join the workforce they demand greater work/life balance in return for their loyalty. On the other hand, as baby boomers age, the need for health related leave, including treatment for illnesses like cancer, increase. Internationally, the United States lags behind other first world nations.

According to the Center for Economic and Policy Research, “The United States is the only one of 22 rich countries that fails to guarantee workers some form of paid sick leave.” In addition, among the 22 nations, the United States is only one of three that doesn’t require employers to pay workers who miss five days due to the flu and the only one of the 22 nations that does not offer paid sick leave for someone undergoing a 50-day cancer treatment.

In response, government entities have initiated a bewildering array of regulations for employers. Typical of the requirements on employers is the new state law in Massachusetts that went into effect July 1, 2016. Employees accrue 1 hour of paid sick leave for every 30 hours worked, up to 40 hours per year for employers with more than 11 employees. Sick time accrues from date of hire, but is not available for use until 90 days of employment. Finally, employees may carry forward up to 40 hours per year. If employers choose to pay out the sick leave at year end, there are additional provisos in place. For example, if the employer pays out 16 hours at year end, they must allow for up to 16 hours of unpaid time as a lump sum at the beginning of the year. For a complete list of current laws, see the website of A Better Balance, an employee advocacy group.

What do employers need to do?

There are 4 steps for employers to consider:

- Determine if you are covered by any of the Required Sick Leave requirements. You may not be a Federal contractor, but may have indirect responsibilities through your customers. Not having an office, or even an employee working in one of the cities or states with regulation may not exempt you from coverage if employees travel to the jurisdiction and meets the minimum working requirements. For example, employees who work 240 or more hours per year in Seattle, Washington are covered by that city’s requirements, regardless of company location or employee place of residence.

- Review your paid sick leave policies to see if they already comply. Be sure to consider beyond the number of hours. Often leave plans may fall short of meeting some of the other requirements for when time is available and rollover requirements. Consider migrating from traditional Sick and Vacation leave to a combined Paid Time Off (PTO) policy.

- Will changes apply for some or all? If policies require revision, will the policy be changed by exception (for example, for those employees working on projects in Seattle) or will a general change to your leave policy be a better choice? Will there be any unintentional disparate or discriminatory result if the plan is applied selectively. Seek legal counsel if you are unsure.

- Communication – Be sure to update your employee handbook if policies are changed and communicate the changes to employees and supervisors. It is essential that everyone in the organization understand and comply with the new laws.

How Sage HRMS Can Help

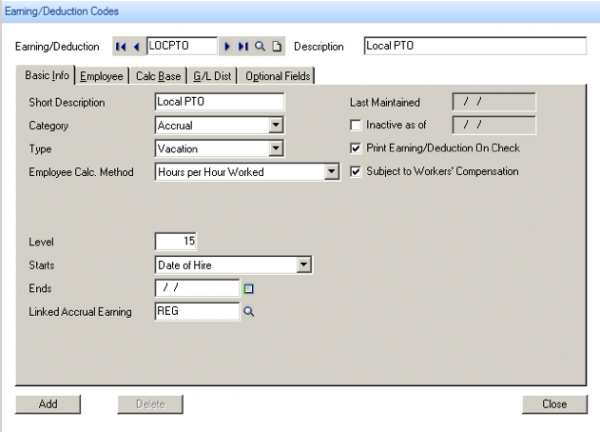

Sage HRMS has a robust Paid Time built into the HRMS Core. With Sage Payroll module, you will be able to track and accrue time based on hours worked, as well as control the plan year and carry over requirements.

Figure 1 ‘Hours per Hours Worked’ is built in

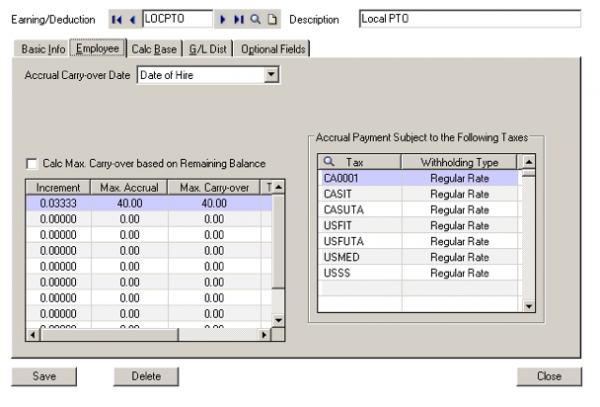

Figure 2 Calculation to 5 decimal places

Sage HRMS also gives you unlimited ability to create new plans and apply them to employees or transfer employees from one plan to another, if they moved home or work locations.

For more information on working with one of our professional services business analysts to design and implement a Paid Time Off plan, please contact the Employer Solutions practice at www.netatwork.com or 800-719-3307.