Employer Solutions / HRMS Newsletter – August 2016

Keeping You Up-To-Date With Information About Employer Solutions / HRMS

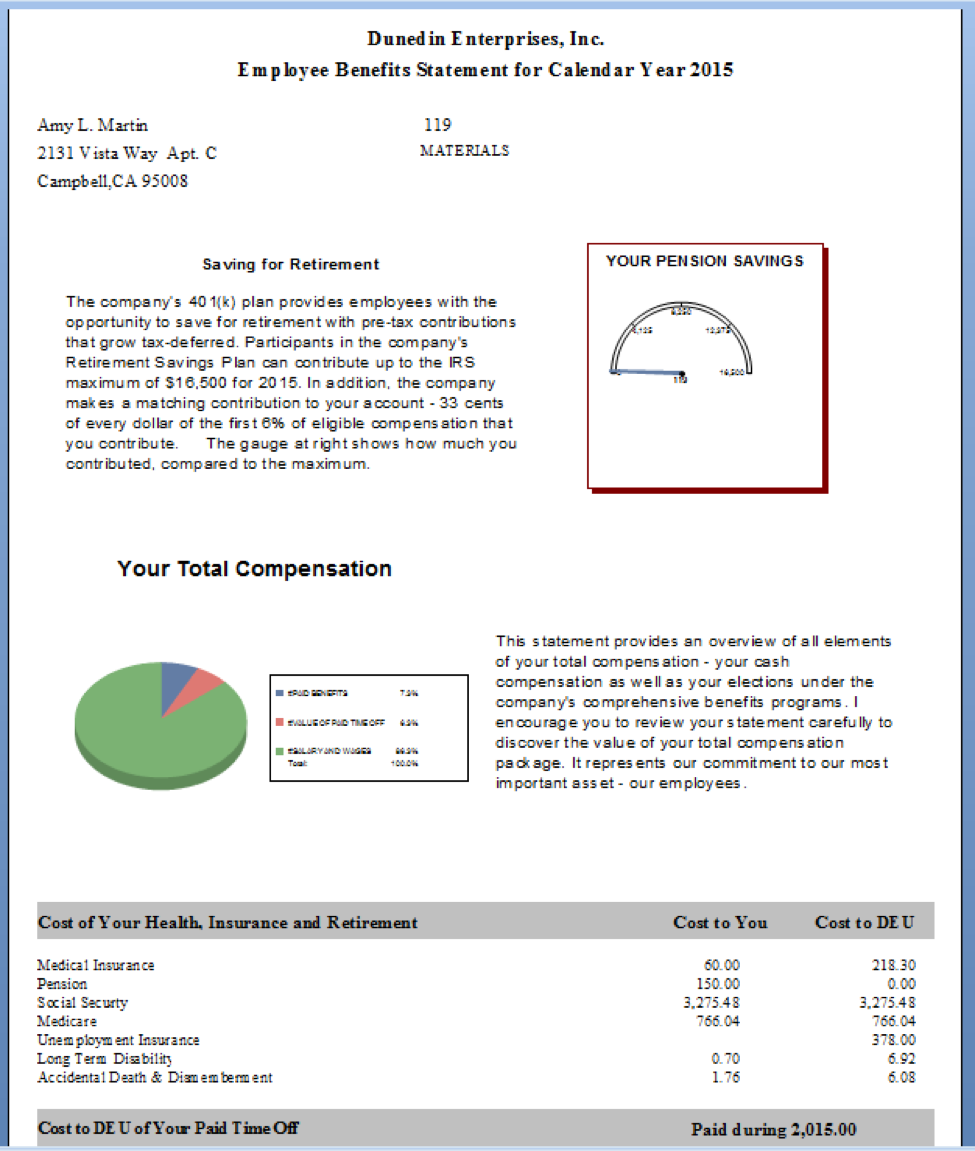

Total Compensation Statements Encourage Employee Engagement

An informative total compensation statement promotes employee engagement. When employees are presented with all of the benefits – tangible and intangible – of employment with you they can better evaluate the true worth of their job. This leads to greater employee loyalty and lessens the possibility that they will consider leaving the organization – a costly and disruptive process. Engaged employees, on the other hand, enhance the organization’s response to its customers. Employee satisfaction drives customer satisfaction.

An informative total compensation statement promotes employee engagement. When employees are presented with all of the benefits – tangible and intangible – of employment with you they can better evaluate the true worth of their job. This leads to greater employee loyalty and lessens the possibility that they will consider leaving the organization – a costly and disruptive process. Engaged employees, on the other hand, enhance the organization’s response to its customers. Employee satisfaction drives customer satisfaction.

Total Compensation Statements Give the Complete Picture

Total compensation statements give employees information on the complete pay package awarded to them on an annual basis, including both direct and indirect compensation. Direct compensation can be defined as “all compensation (base salary and/or incentive pay) that is paid directly to an employee.” Indirect compensation can be defined as “compensation that is not paid directly to an employee and is calculated in addition to base salary and incentive pay (e.g., employer-paid portions of health/dental/vision insurance, retirement benefits, educational benefits, relocation expenses, employee paid time off).” The more detail that an employer can provide, the more beneficial the statement. Some common items to include in a total compensation statement are:

- Salary/hourly rate

- Medical benefits coverage—include amount paid by employee and employer

- Flexible spending account information

- Paid leave—include vacation/sick/PTO, holiday, personal, bereavement, military pay, jury duty, etc.

- Disability insurance

- Life insurance

- Employee assistance program

- Retirement benefits—include 401(k)/403(b), pension plans, etc.

- Educational assistance programs

- Relocation expenses

Creating the Total Compensation Statement in Sage HRMS

There are a number of tools in Sage HRMS that can assist in creating an accurate Total Compensation Statement including standard reports and Secure Query. Data in Sage HRMS includes employee and employer contributions to benefits, paid time off, training information (requires the Sage HRMS Train module) and pay history (requires the Sage HRMS Payroll module). Additional data can be tracked in custom tables, including payroll data imported from 3rd party payroll processors, additional benefits like uniforms, company vehicles or equipment. Although standard reports capture the many of these elements, for a complete picture the best tool is Crystal Reports.

Using Crystal Reports to Create the Total Compensation Statement

Crystal Reports for Sage HRMS provides a robust reporting platform for HRMS users. Features typically used in Total Compensation Statements include

- Conditional lines (to personalize the statement based on the individual employee’s benefits)

- Parameter fields (to dynamically allow for running the report without having to reprogram for a different group of employees or effective dates)

- Formulas (to capture complex calculations or control how data is displayed)

- Graphs and Charts (to make the Total Compensation Statement more visually appealing).

In the example below, we have combined many of these elements:

Next Steps: Our Consultants Can Assist

If you would like help creating total compensation statements, or any customized reports, please contact the Employer Solutions practice at Net at Work to schedule time with one of our experienced Business Analyst\Consultants. For more information and to schedule an appointment to discuss your needs, contact us at 800-719-3307.