New Features for Bad Debt Management in Sage X3

New Features for Bad Debt Management in Sage X3

Bad debt is a contingency that must be accounted for by all businesses who extend credit to customers, as there is always a risk that payment will not be received. The latest release of Sage X3 has new features to help you limit this bad debt risk by:

- identifying and managing bad debts

- creating journal entries which will allow your business to have better visibility on bad debt

- more easily calculating accruals on debts that may not be recovered

- writing-off bad debts while meeting local legal requirements

This post will introduce the new parameters and activity codes related to this new function. The Sage X3 Online Help Center contains more detail about the options available and how to use the features.

Bookmark Sage Support Resources today!

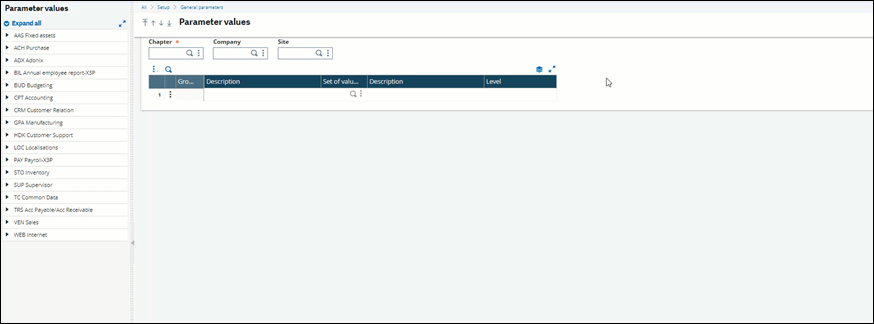

Define the new parameters by navigating to the Parameter values screen. Select the CPT chapter and CLO group.

- Define the bad debt process using the following parameters:

- Bad debt date filter rules (BDTDR) – specify the date used in calculating bad debts

- Bad debt management rules (BDTMGT) – define the management rules at the company level

- Select the automatic journals for the following parameters:

- Bad debts – doubtful receivables (GAUBDTDOU)

- Bad debts – direct write-off (GAUBDTDWO)

- Bad debts – impairment (GAUBDTIPR)

There are two new activity codes:

- Bad debt management (BADBT) – controls all the developments related to bad debt

- Number of Bad debt lines (BDE) – limits the number of lines that can be uploaded in a bad debt function. The default value setup is 300.

Bad debt management example:

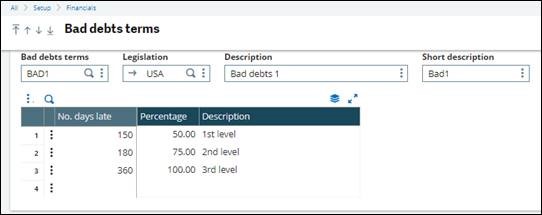

Create the terms that will be applied in calculating bad debt values using the Bad debt terms screen (GESBDT).

Enter a bad debt terms code, legislation for which the terms can be used for, description, and short description. Specify the number of days between the accounting due date of an open item and the actual date. The percentages entered will apply to the corresponding number of days in the bad debt management process. Note that for the days and percentages, the following rules apply:

- No negative values

- Values can be equal to zero

- The value of the next line should be higher than the previous one

- “No. of days late” must be presented in ascending value

- The value in “Percentage” should never be higher than 100

- No two lines on the grid can have the same value

- No bad debt term code can be saved if the grid is empty—it should have at least one entry

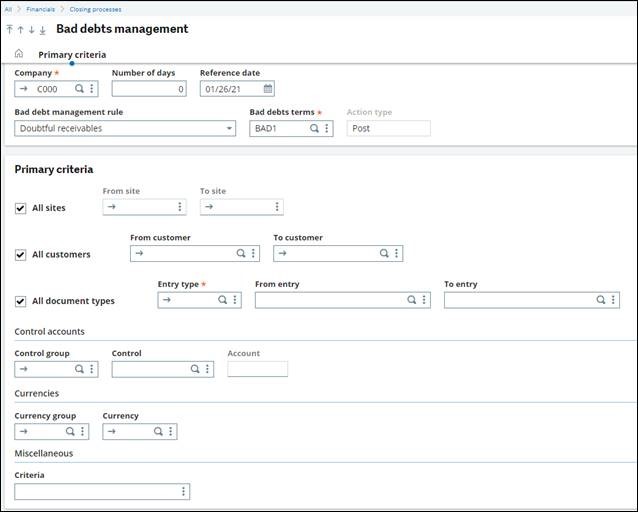

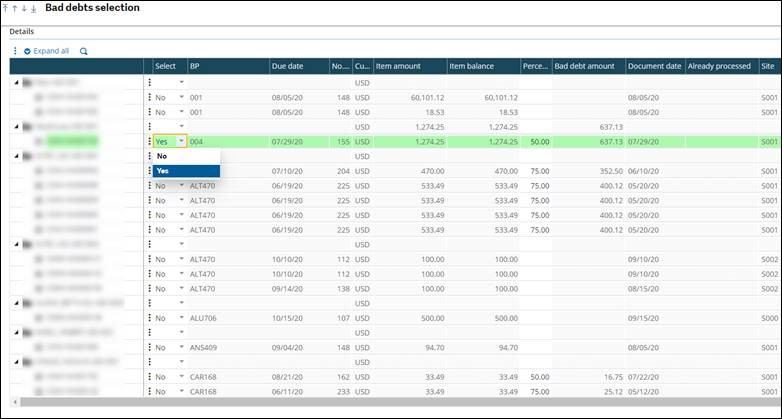

Next, define which company and which bad debt management rule is used, select which open items are used to create new bad debts in the Bad Debts Management screen (BADBTGEN). Bad debt management does not apply to late supplier invoices, only to customer invoices and open items.

Start by entering the company and the bad debt management rule. The options are doubtful receivables, impairment, or write-offs. Next, select the bad debts terms, which contains the percentage to be applied in the calculation of overdue invoices/open items to be included in the bad debt management processes. Further define the open items in the Criteria field. Select OK when ready to go to the next step.

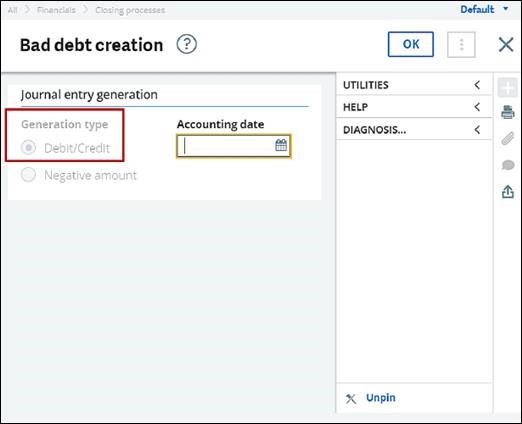

Select which entries will be posted as bad debt. See how much will be posted as bad debt in the bad debt amount column. Select OK to create the journal entry and to complete the process.

For more information on using the new features in Sage X3 to help limit bad debt risk, please contact us.