Custom Tax Rule to Override AvaTax Calculations for Product Exemption

Custom Tax Rule to Override AvaTax Calculations for Product Exemption

When you need to exempt specific products from sales tax for a non-exempt customer in a jurisdiction where you collect taxes, this guide will help you create a custom tax rule in AvaTax.

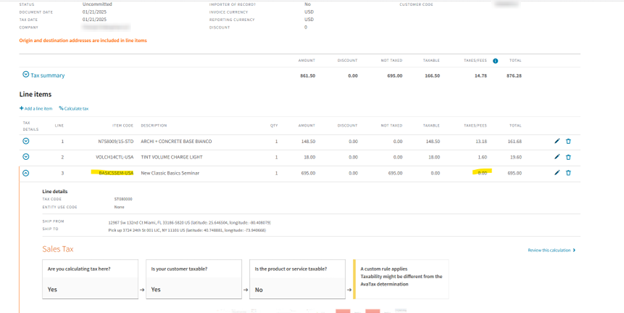

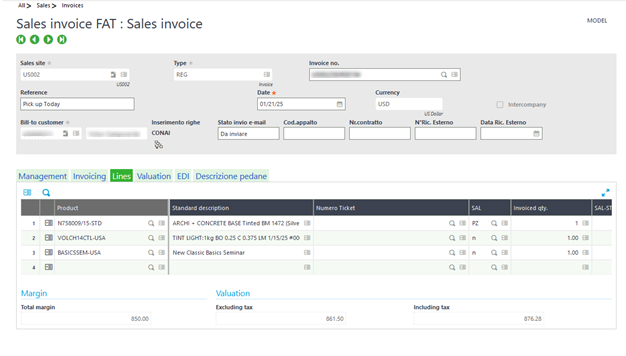

For example, in the invoice below, a service (New Basic Seminar) should be exempt from sales tax, while the other products remain taxable. Here’s how to configure this rule in AvaTax:

Steps to Create a Custom Tax Rule

- Access Custom Rules Page

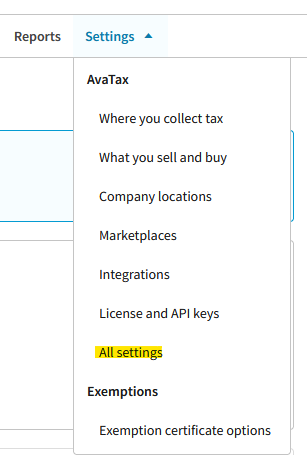

- From the Avalara Portalpage, go to Settings > All settings.

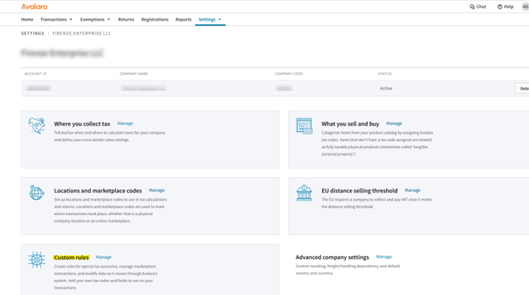

- Under the Custom Rules tile, click Manage to open the Custom Rules page.

- Go to the Tax Rules tab and click Add a Tax Rule to open the New Custom Rule page.

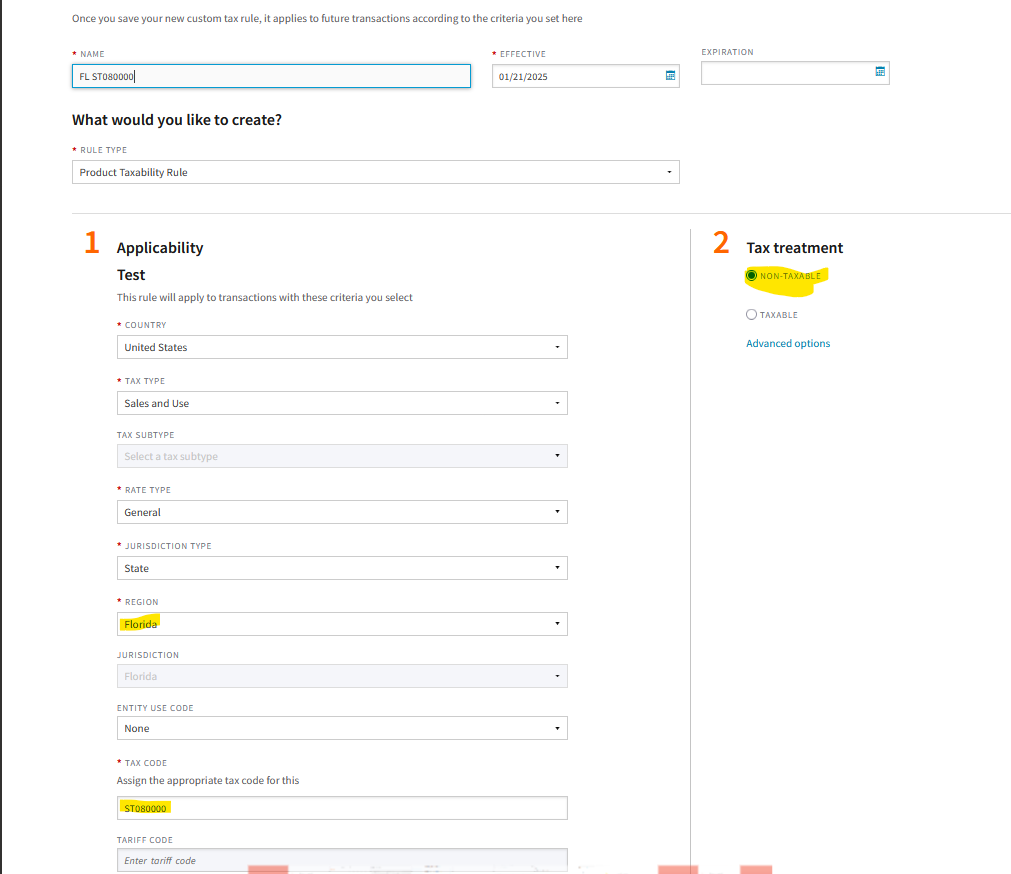

- Enter rule information on the new custom rule page

- Name: Provide a clear and descriptive name for the rule.

- Effective & Expiration Dates: Specify when the rule should start and end (if applicable).

- Rule Type: In this field, you need to choose the custom rule that you want to apply. For this example, we’re going to select the “Product Taxability Rule”, which determines whether an item is taxed in a specific jurisdiction.

- Location: Each custom tax rule applies to a single location. Create separate rules for each location if needed.

- Define the Taxability Rule

Begin by choosing whether this rule makes the item taxable or nontaxable.

If it’s taxable, you then need to specify whether the rule includes special handling and designate either a cap or threshold value.

- Cap Option: Set a tax cap and choose how to apply it:

- Cap the taxable amount at the document level.

- Limit the tax on the line to the cap amount.

- Exempt the entire amount after the cap is met.

- Threshold Option: Set a threshold amount and define its application:

- Tax the entire amount once the threshold is met.

- Specify the Jurisdiction & Tax Rate Basis

- Choose the jurisdiction where the rule applies.

- Select how the tax rate should be determined:

- Ship-from address (origin)

- Ship-to address (destination)

- Use system sourcing (AvaTax decides automatically)

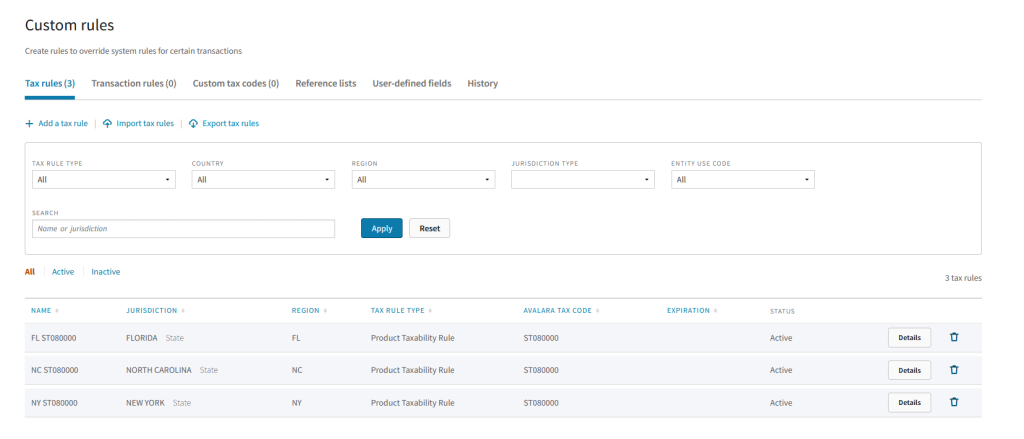

Finalizing & Applying the Rule

- Remember to create a rule for each jurisdiction that you want it applied.

- Your new custom tax rule will now apply to transactions moving forward.

- To apply it to past transactions, re-save sales data or recalculate tax.