Reinstatement of Superfund Chemical Excise Tax:

Reinstatement of Superfund Chemical Excise Tax:

New Sage X3 ERP Accounting and Calculation Functionality for the Chemicals Industry

Chemical companies need to prepare for the return of an excise tax on chemicals produced or imported that hasn’t been in effect for nearly 30 years. In January 2022, the IRS published Notice 2021-66, related to the Infrastructure Investment and Jobs Act (“IIJA”), which revives the excise taxes imposed on certain chemicals—previously known as the Superfund Chemicals taxes.

Prior to their expiration in 1995, the Superfund chemical excise taxes were used to fund the Hazardous Substance Superfund. Expenditures were administered by the Environmental Protection Agency and used to clean up hazardous waste sites around the United States. Reinstated, the Superfund excise taxes will apply to a long list of chemicals and chemical-containing substances, effective July 1, 2022 .

Chemical companies will need to brush up on the body of excise tax law and IRS guidance. They will also need to undertake a detailed review of the chemicals they manufacture or import for sale or use, as well as the chemical composition of the products they import, to understand if a product is subject to the Superfund excise taxes and, if it is, how to timely report and remit tax or register for an exception.

Superfund Excise Tax on Chemical Sales

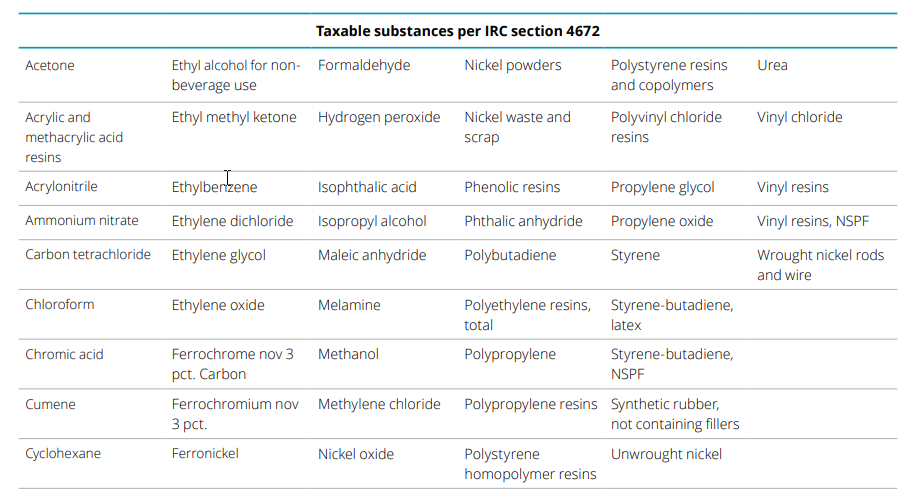

The return of the Superfund excise tax on chemicals affects taxpayers that manufacture, produce, or import certain chemicals, as it imposes an excise tax on the sale of 42 specific chemicals listed in Section 4661 of the tax code, including ammonia, butane, benzene, mercury, and other common products. Any manufacturer, producer, or importer that sells or uses them must pay a per-ton tax of $0.48 to $9.47, depending on the chemical.

There are some exemptions, such as the use of methane or butane for making motor fuel, the use of some chemicals to produce fertilizers, and substances derived from coal.

Superfund Excise Tax on Importers of Taxable Substances

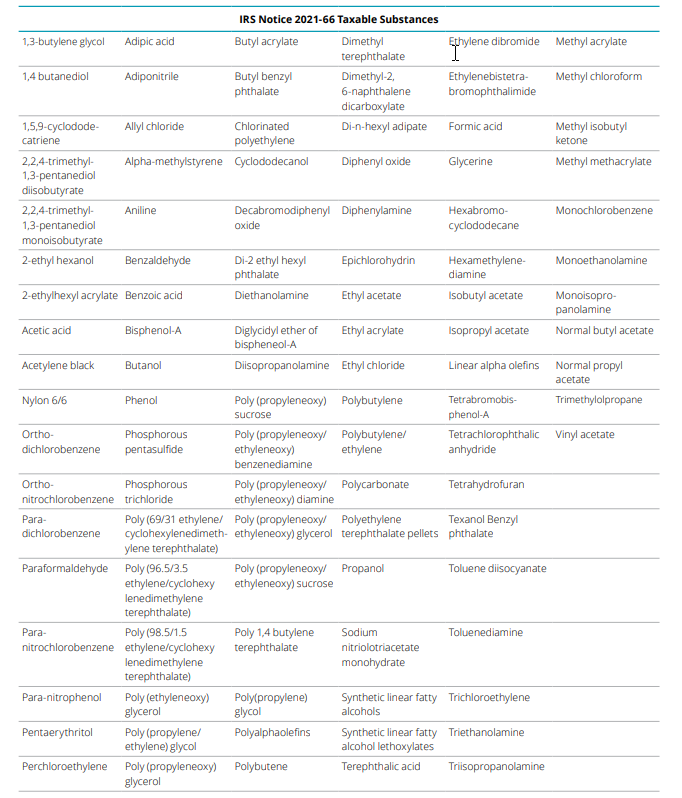

For importers, the IRS listed 151 substances a taxpayer intends to use or sell as subject to the tax but only if the weight of the substance contains 20% or more of a taxable chemical. Among those substances are ones with common consumer uses like glycerol and butanol. Compliance with the reinstated tax will likely require taxpayers’ tax advisers to work closely with operations and procurement departments.

Reporting Requirements

Reinstatement of the Tax is projected to bring in an additional $14.5 billion over the next 10 years.

Taxpayers subject to the new Superfund chemical taxes will be required to report on Form 6627, which must be filed together with the Quarterly Federal Excise Tax Return (Form 720). With these taxes due to take effect on July 1, 2022, taxpayers are responsible for compliance beginning with the Q3 2022 filings due October 31, 2022. Penalties and interest may apply for late deposits, ranging from 2% to 15% depending on the number of late days. A late filing penalty may apply for the failure to file a Form 720 of 5% per month of the amount due, up to 25%.

New Functionality for Sage X3: Superfund Excise Tax Calculations

Net at Work has introduced new Sage X3 functionality for companies impacted by the Superfund Excise Tax. This new functionality not only manages the accounting for Superfund but can easily be extended for other surcharges or rebates based on weight of product.

Net at Work’s Superfund Excise Tax solution includes:

- Product Master Supplier and Customer Surcharge setup

- Purchase and Sales Invoice element product surcharge setup

- Product/Customer waive surcharges

- Product/Surcharge/Customer waive options

- Product/Surcharge/Customer markup options

- Product/Surcharge/Customer custom pricing options

- Surcharge override and recalculation at Sales Order

- Recalculation based on shipped/received quantities and amounts

- Product Surcharges available at Sales Order, Deliveries, Customer returns, Sales Invoice and Credit memos.

- Product Surcharges available at Purchase Order, Receipt, Supplier returns, Sales Invoice and Credit memos.

- Product Surcharges available at automatic delivery and invoice generation.

To learn more about Net at Work’s new functionality for Sage X3 and how it can help your company remain compliant, please contact us, or reach out to your Account Manager directly.

For more information about the Superfund Excise Tax please see:

- H. R. 3684 – Infrastructure Investment and Jobs Act

- IRS Notice 2021-66

- Previously recorded webinar by KPMG: Superfund Excise Taxes – They’re Back!

NOTE: Portions of the blog post were originally posted by Chris M. Hunter with Jackson Kelly PLLC on May 16, 2022 as well as by Mayer Brown LLP on March 10, 2022 for Bloomberg Law.