Checking Out Fixed Assets No Longer “Fixed”

Mobile Fixed assets are now the norm and not the exception. In fact, ‘fixed’ asset is an oxymoron in our current national crisis. I have been speaking to clients and coworkers for the past 45 days that are setting up home offices for the first time. The average Home worker can have up to 5 assets per office. Whether they are expensed or capital assets, Good Accounting practices include tracking assets especially when they become mobile.

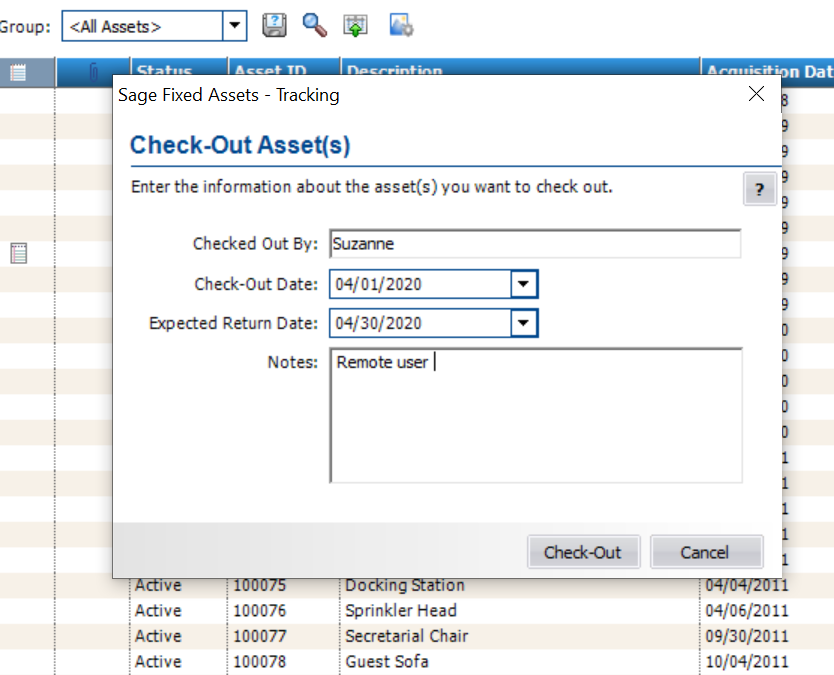

Some companies will find themselves back to normal in offices all over the globe. However, some will decide that keeping staff at home may help reduce some overhead in post Covid-19 economic recovery. Regardless, organizations now more than ever, need to know what assets are mobile and where they moved. Now is great time to evaluate your Fixed Asset process for updated fields for ‘checking out’ moving assets to external locations.

Fixed Assets are Suddenly Mobile “At Home” Assets: Do You Have a Check In / Check Out System?

There are many benefits to recording assets that are “Checked out” . Here a few :

- Accurate Property tax records

- Inventory audit accuracy

- HR Exit documentation

- Purchasing reductions

- Server Assets Backup Retention Shared Space

Even our own organization will see benefits. For example, my company assets here in Florida for Net at Work (HQ in New York), has a lower property tax rate if they are reported this asset. Let’s say you don’t want to track them for capital cost of property. The organization will still need to know where assets are that may contain company propertary data, or client data. One recommendation is to make separate Class Code for Expensed but trackable assets.

Do you know what is expected back from the employee? Are the assets tagged with a Company Property ID#? These questions are certainly the topic of discussion all over the globe. If your current solution does not have a Checked In and Check Out feature – Reach out to us for more information or a Software Demo.