Accounting for an Invoice in Sage X3 When the Goods Haven’t Been Received

Accounting for an Invoice in Sage X3 When the Goods Haven’t Been Received

Finance departments spend a lot of time determining which items need to be accrued for at the end of a period. In the majority of cases, the reason for an accrual is because goods/services have been received but not yet invoiced. The accrual is put in place to allow them to recognize the expense and the eventual liability on the balance sheet.

But what happens when an invoice is received prior to the goods/services being delivered? This is a fairly common occurrence in overseas transactions these days due to heavy delays with international commerce.

In this blog post, we will review the best way to address this issue in Sage X3.

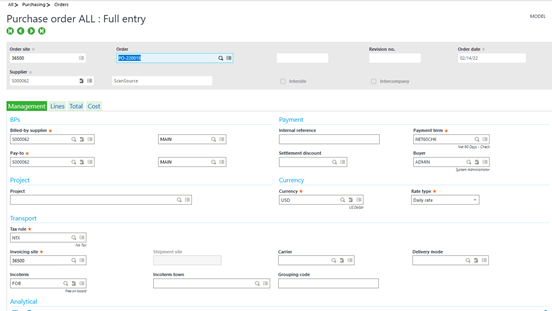

Here we create a regular Purchase Order:

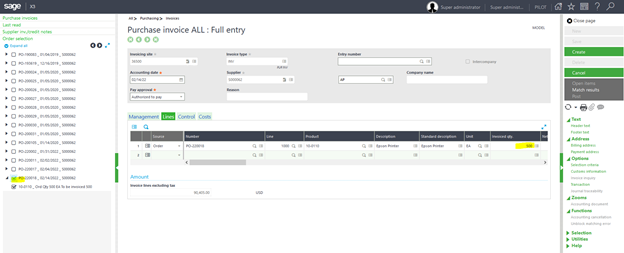

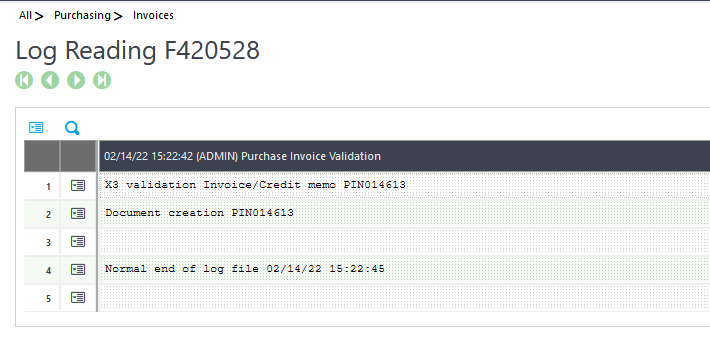

However, instead of the typical PO > Receipt of Goods > Invoice process, this situation requires the receipt of the invoice prior to the receipt of the materials. As mentioned above, this is fairly common in overseas transactions and may or may not involve a pre-payment (this sub-process will be analyzed separately):

In our example we are receiving the invoice for the complete quantity, 500 units.

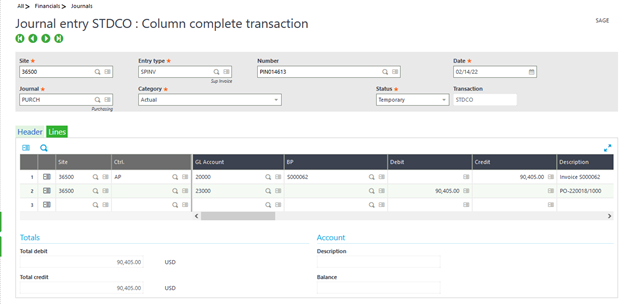

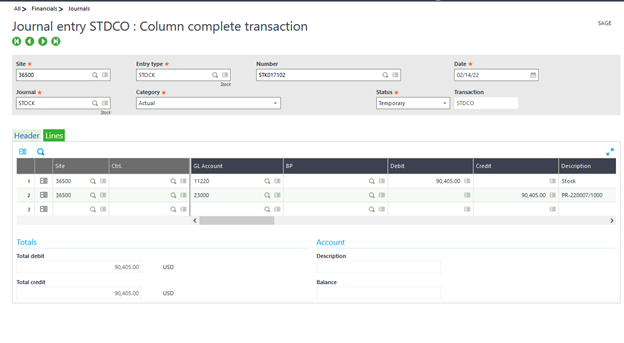

Upon posting of the invoice, we review the journal entry. SAGE X3 created the credit to Accounts Payable and the debit to Purchase Accrual (GL account 23000 in this example).

This creates a temporary imbalance on the accrual account because the material was not received, so the credit accrual is not yet created.

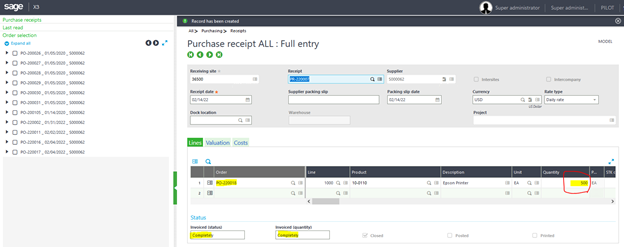

On the next step we can see the PO Receipt. If the invoice was linked to the PO, the receipt CANNOT BE MADE for a quantity less than the quantity invoiced (500 units in this case). Following the creation of the receipt, the Purchase Order is automatically closed by X3:

Here’s the journal entry generated by the receipt. As you can see, the accrual is going to the credit side, balancing the previous charge from the invoice. The ending result is a debit to Stock and a credit to Payables, the regular AP accounting flow.

Because the receipt could be delayed for several weeks or months, it’s important to understand that there could be an improper balance reflected in the AP accrual account in the meantime. It’s important to verify the POs invoiced but not received to make, if the amount is significant, a correcting GL entry at month’s end that will be reversed the first day of the following month.

For more information on how to account for an invoice when goods haven’t been received, or for any other Sage X3 questions, please contact us.