Sage Intacct Newsletter – May 2024

Keeping You Up-To-Date With Information About Sage Intacct

Sage Intacct Monthly Tech Tip

Should I delete or reverse an incorrect entry? Which is better?

Intacct users are only human, and errors are inevitable. Which is better, reversing an entry, or deleting it? Good question! Reversing an entry removes the effects of that entry while still maintaining an audit trail. Deleting an entry completely removes it from the system as if it had never been there at all. This allows the entry to be re-entered correctly without the in, out and in of a reversed and corrected transaction. Which one to use is a matter of preference and policy.

Entries in the General Ledger can be either deleted or reversed from the list of Journal Transactions. Go to General Ledger, All, Journal entries. Beside the appropriate journal, click on View transactions. Select transactions on the left to reverse and select transactions on the right to delete.

If you open (view) a transaction, you also have the option to reverse the transaction from that screen.

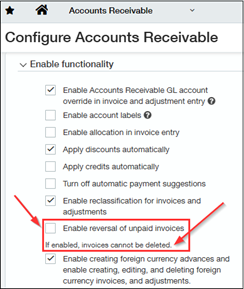

In both Accounts Payable and Accounts Receivable, you do not have the option of both reversing and deleting. The configuration of AP and AR allows either reversals or the ability to delete. The exception to either delete or reverse option is a draft document. Since a draft transaction is not yet posted, it can be deleted even when the reversal option is enabled.

It is important to note that even when the reversal option is turned on, only unpaid invoices or bills can be reversed. If a bill is paid, the payment must be voided before the bill can be reversed.

Similarly, when the reversal option is turned off, a charge payoff transaction cannot be deleted; it can only be reversed.

There’s a lot of variables to consider when reversing or deleting transactions.

Please reach out to us if you have any questions!

helpdesk@netatwork.com

646-293-1777