Employer Solutions / HRMS Newsletter – October 2016

Keeping You Up-To-Date With Information About Employer Solutions / HRMS

Reconciling the Benefit List Bill – Industry Challenges

Premium billing and reconciliation is a challenge for any company. Carrier premium bills will almost always differ from what an employer thinks should be correct.

Premium billing and reconciliation is a challenge for any company. Carrier premium bills will almost always differ from what an employer thinks should be correct.

Some differences are due to timing of eligibility files processing, premium statement generation, and actually receiving a bill. This can cause errors and allow for ineligible employees to be carried on a carrier’s billing system indefinitely. The time spent comparing the carrier bill to the employer’s listing can take weeks to complete each month!

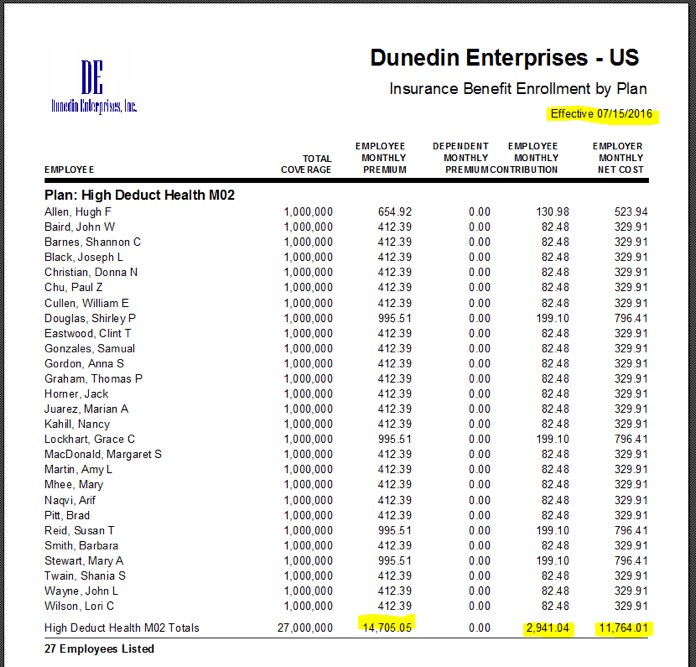

Benefit costs continue to escalate making careful review of the monthly vendor list bill an important financial responsibility of HR. For a company’s benefit administrator, up to 20% of their time is spent just reviewing and confirming the bill from vendor for benefits. Often benefit providers fail to account for mid-month adds and drops or changes in level of coverage. This can lead to inaccurate charges and possible over billing which the company has to absorb. The key is to have a complete data picture and easy reporting capabilities to be able to compare the employer’s records against the vendors at a moment’s notice. In addition, careful reconciliation of the vendor bill can uncover inaccurate benefit information that could cause increased employer liability in the event the employee needs use the benefit.

Employee benefit changes can have a number of sources. Employees can become eligible for benefits due to new hire status or qualification based on hours worked (“variable hour employees” in ACA parlance). Employee may also become eligible for a change due to a qualifying event: marriage, divorce, birth or adoption of a child or changes to the law (for example, same sex marriage laws). Employees may also have benefit changes due to leaves without pay, FMLA-related leaves or Worker Compensation.

How Sage HRMS Can Help

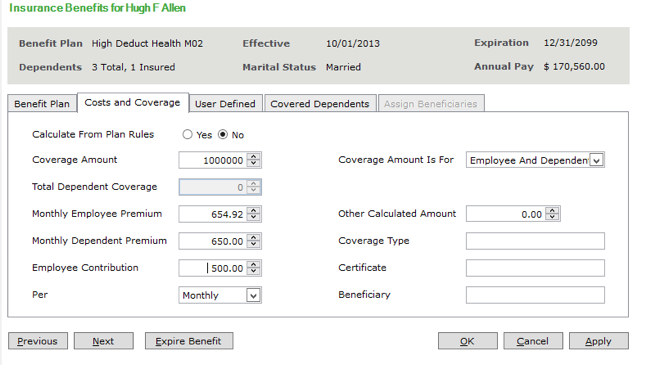

Effective benefit administration in Sage HRMS begins with planning for and implementing accurate benefit plans. Benefit calculations can include dependent information, formulas and other calculations based on years of service, age or job classification.

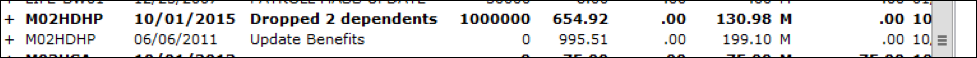

Once employees and their dependents are enrolled in benefits, HRMS will record changes and effective dates throughout the employment of the employee.

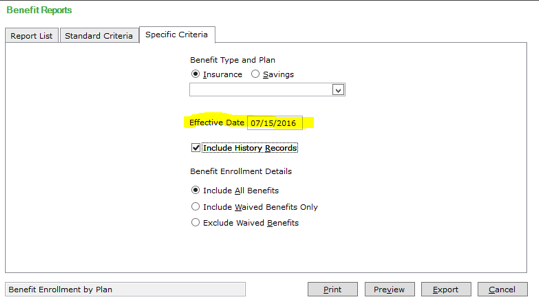

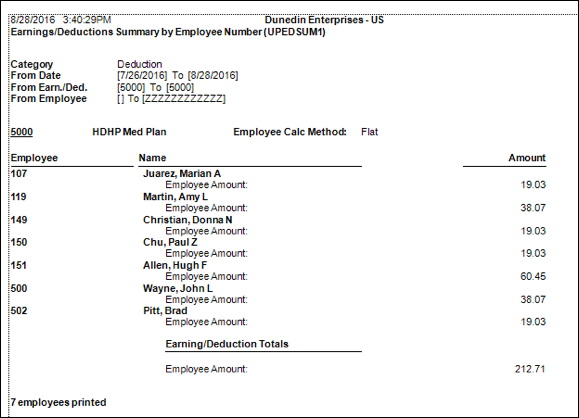

By keeping track of changes based on effective dates, HRMS can, in turn, report benefit enrollment and cost at any point in time.

Benefit Administration in HRMS drives deductions and employer fringe benefit costs into the Sage Payroll module. This assures that data flowing to the General Ledger thru Payroll will be accurate and time effective.

If you would like to find out more information about benefit administration in Sage HRMS, including online Benefit enrollment and carrier connectivity, please search for the Employer Solutions practice on the Net at Work website, www.netatwork.com, or by calling us at 800-719-3307. (Note: see last month’s newsletter for an article on ‘Creating a Total Compensation Statement’ and watch for webinar on Creating Benefit Statements.)