1099-MISC/NEC Processing in Sage X3 & Sage 500

It’s the time of year again when thoughts turn to holidays and family… and year-end closing routines including 1099 processing!

In this post we will review the requirements for both Sage X3 and Sage 500 as you close out 2020 and get ready for 2021.

Sage X3

Last week, Pam Nightingale, Senior Sage X3 Support Analyst, published a fantastic article about 1099 processing within Sage X3. It covers all the basics and has links to information you will need for this year. Pam also authored a blog post that covers the 2020 NEC changes. Most important to note is that the 2020 updates for 1099 were included in v11.0.18 and v12.024; for other patch levels on v11 and v12 Sage will be releasing a 1099 update. Versions older than v11 will not have a patch for 2020 requirements. If you also need to patch for the 2019 requirements, we can do both at the same time. 2019 supports versions 9, 11, and 12. Please contact your Team Manager at Net at Work or helpdesk@netatwork.com to coordinate patching, if you need support.

Sage 500

Sage also just released a new article for Sage 500 that you can find on Sage City providing information on the 2020 Tax Year that will bring a new 1099 form, the 1099-NEC (Non-Employee Compensation).

Starting with Tax Year 2016, Sage 500 ERP shifted from completely managing 1099 forms and history to using an outside vendor named Aatrix for much of the yearly 1099 processing. Sage 500 ERP now sums up 1099 data and sends that data to Aatrix. From there, Aatrix can print forms, mail forms, send electronic 1099s via e-mail, etc. If you are on a support plan, some of that is included, with additional options at additional cost. AAtrix updates can be found by visiting https://partner.aatrix.com/sage500. Net at Work has also worked with a different third-party solution where data is extracted from Sage 500 and submitted to the third-party. Please contact Net at Work if you are interested in a different solution.

Regardless of your installation’s product update status, the last 1099 update (not necessarily last year’s) must be installed prior to the 2020 1099 update. Tax Year 2019 did not require a 1099 update, so that means the last update was likely Tax Year 2018.

There are two installs, one for the Aatrix system (once installed, Aatrix updates itself via the internet), and the other part is a Sage part that adjusts to IRS driven data changes.

The main change for this year, from a user experience, is that this year they will have to run a Sage 500 database update piece prior to installing Sage 500 client change (due to 1099 table constraint changes).

Please note that any users using Sage 500 v2016 and prior that were able to continue using Aatrix will not have a Sage alternative this year. Sage 500 v2017 and later will be supported.

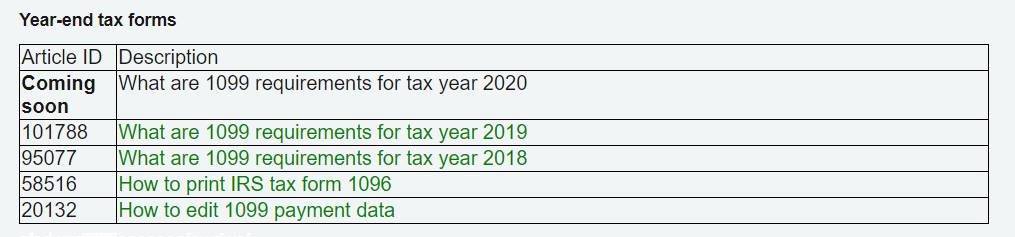

For information on year 2019 and 2018 requirements, follow the URL on the image below:

Please contact your Team Manager at Net at Work or helpdesk@netatwork.com to coordinate patching, if you need support.